I have a Washington Cares withholding for Washington State and it’s nowhere evident in Acumatica, is there something I need to do to get it to appear or is this a deduction I need to set up myself?

Thank you!

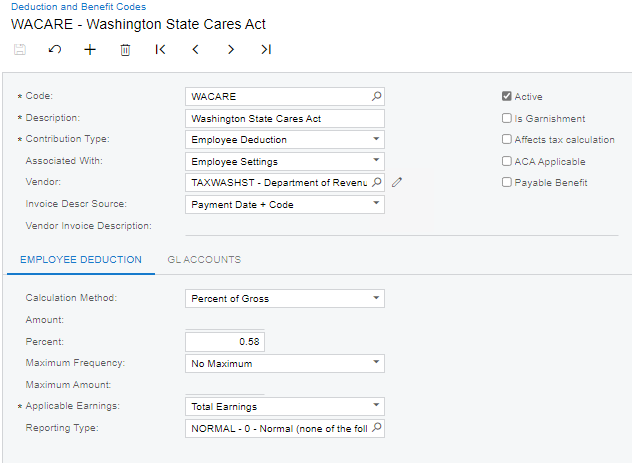

Best answer by mikedavidson07

View original