Acumatica’s payroll tax set up does not allow for the entry of the mandatory SOC codes.

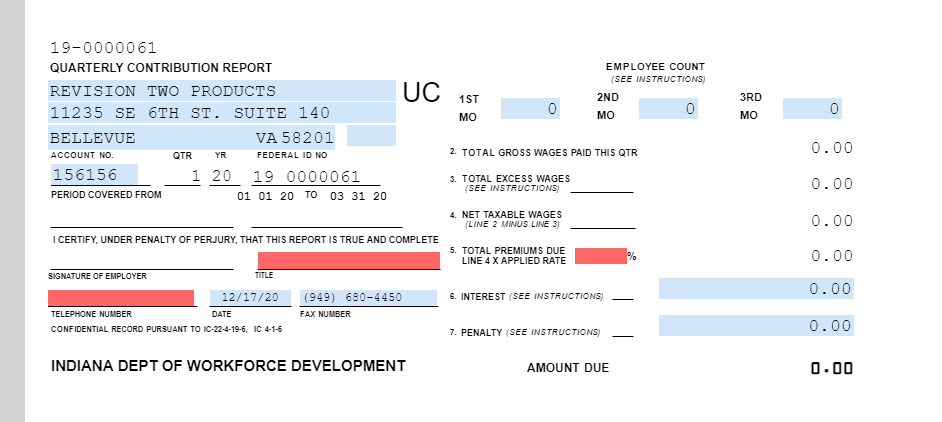

Is anyone else needing to report to Indiana?

Acumatica’s payroll tax set up does not allow for the entry of the mandatory SOC codes.

Is anyone else needing to report to Indiana?

Best answer by Denise Johnson

Thanks Abe for the reply as well.

I’ve looked at the IN UC-1/UC-5A-S eFile Report and do not see the SOC listed. We’ll be glad to research. Please enter or have your Partner enter in a support case. We’ll get started on our side as well. Feel free to send me the case number so I can follow and assist.

As a side note: You can review your reports at any time within Government Reporting. You don’t have to wait till you are ready to eFile. All reports can be reviewed and redone as many times as needed.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.