Hello Acumatica Community,

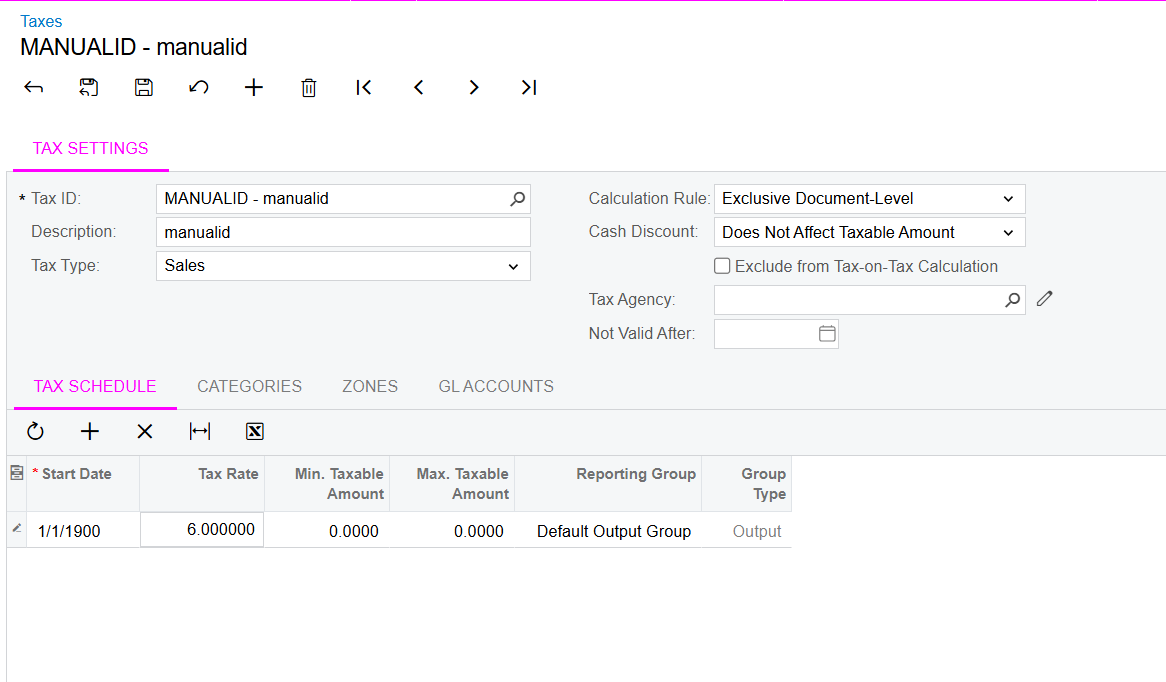

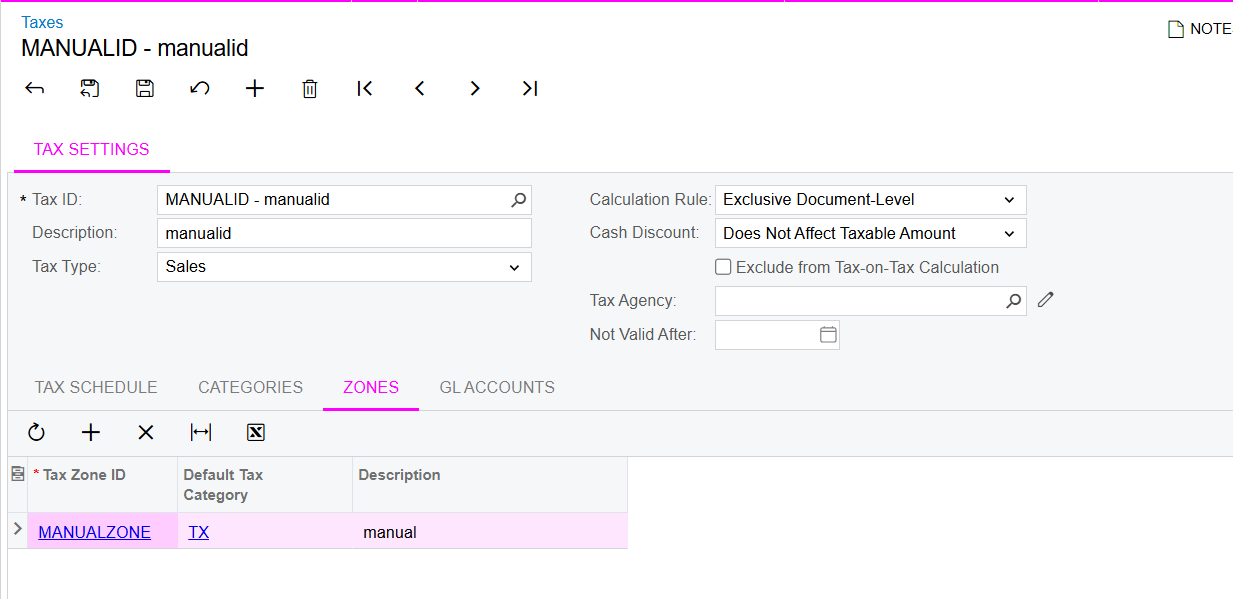

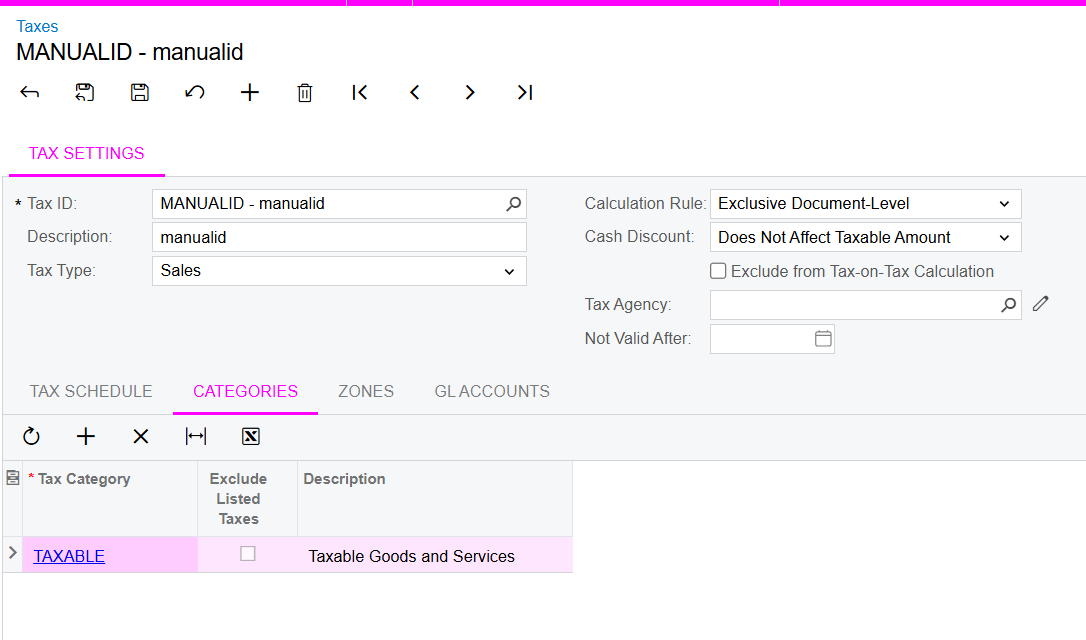

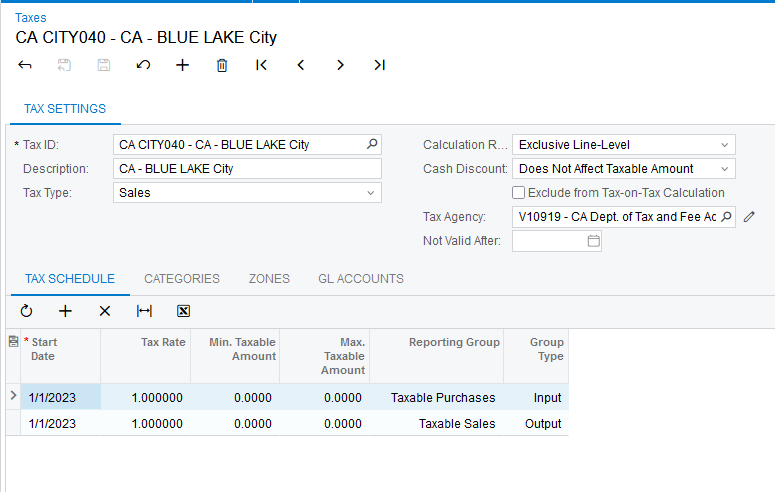

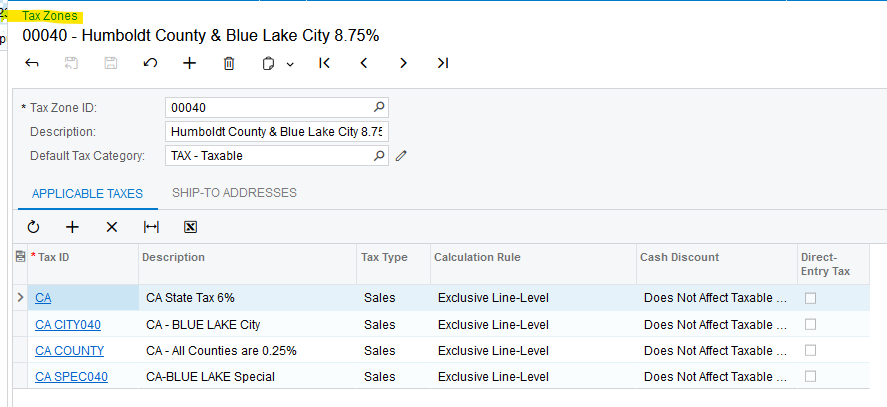

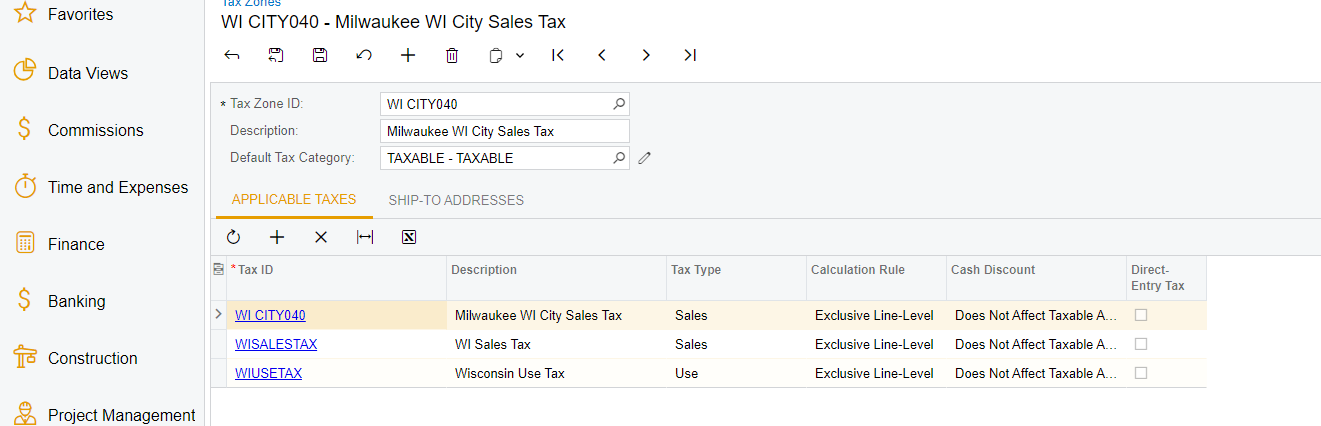

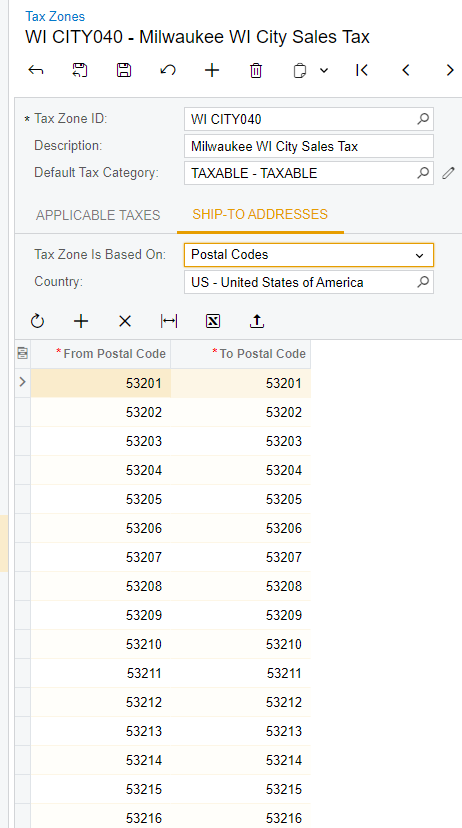

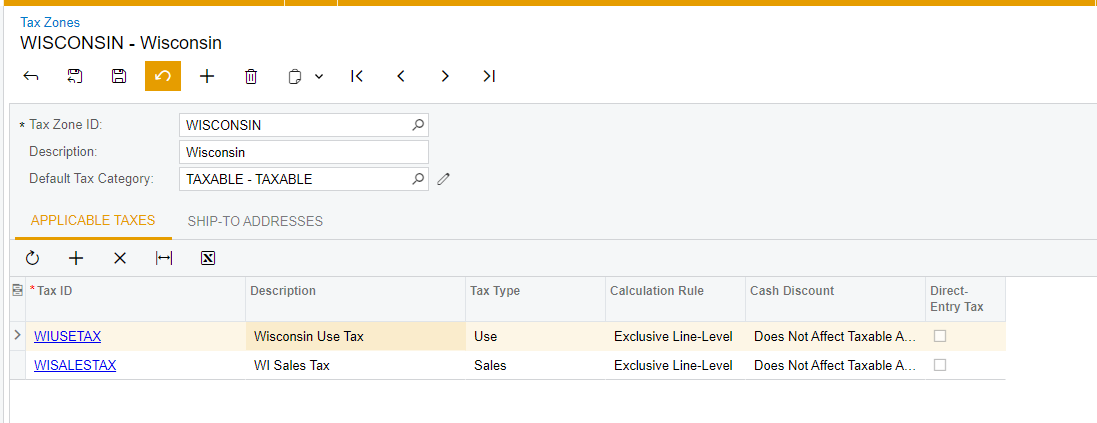

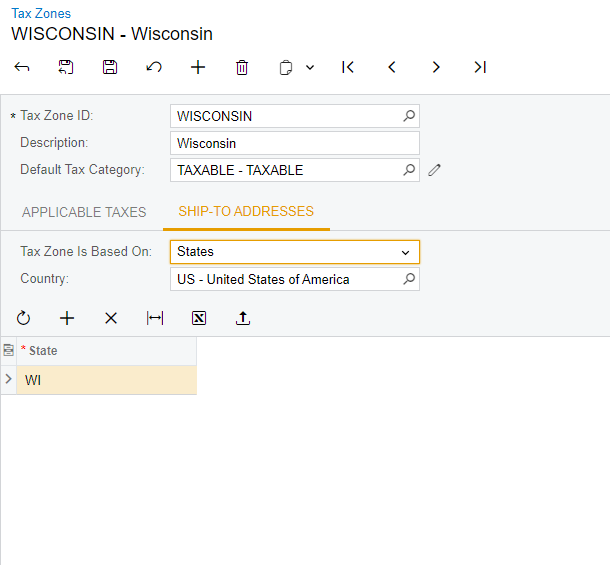

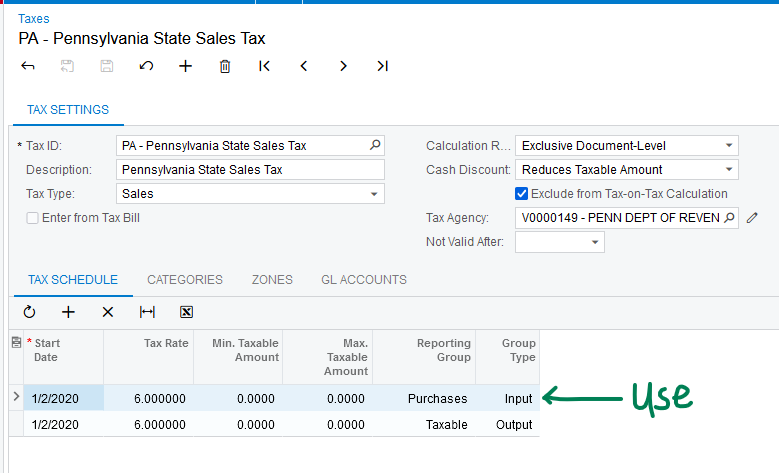

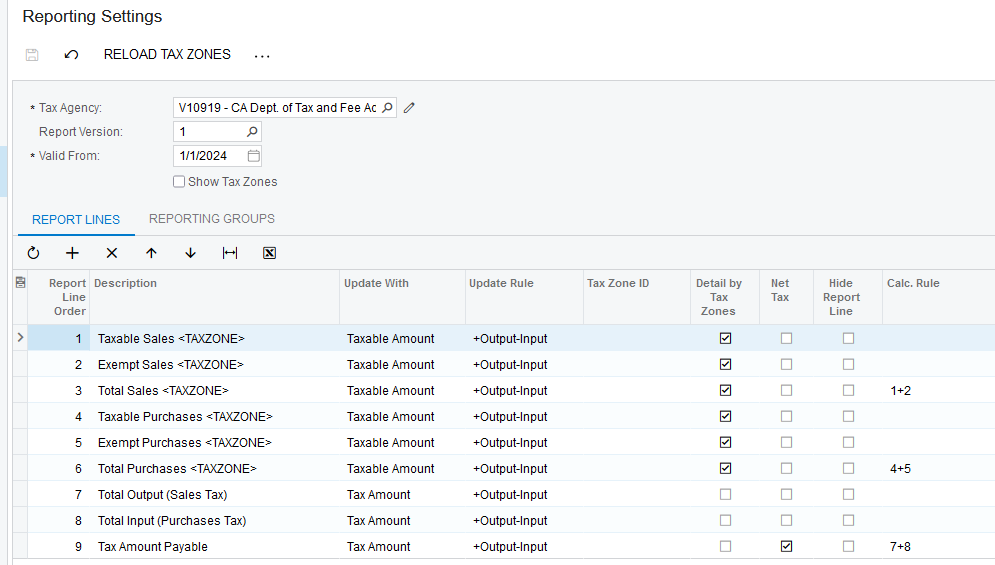

What service have companies used for “simple” sales tax rate updates in Acumatica? We are not looking for something like Avalara but just simply update the rates inside Acumatica for the states there is nexus.

Thanks,

Nirav Shah