Hello,

I’m not sure we have enough information to answer.

Yes, we can have one sales order with multiple tax codes.

If I haven’t answered your question…. please provide your question! 😃

Laura

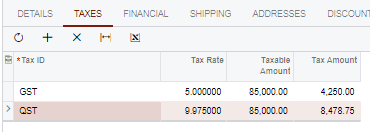

Ex. This order has a pre-tax amount of $85K. We charge GST (5%) and QST (9.97%).

At the header level, this order should see:

VAT Taxable - $85K

Tax - $12K

Total - $97K.

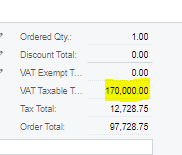

Instead, we see that the VAT taxable amount gets calculated from the fields above - $85K x 2.

I’m struggling to see why this VAT taxable field would be built like this. My expectation is that this field should effectively be the PRE TAX Amount but seeing how it calculates this field when you have multiple types of tax is a real head scratcher.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.