Hi,

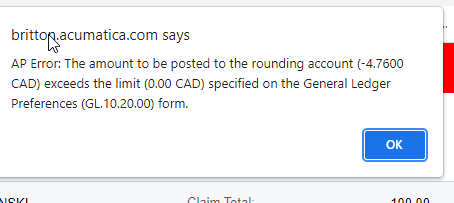

I have someone entering an expense claim using a specific Expense Item. Normally this item is taxable and has taxes calculated but in his instance, the supplier is not charging tax. How can the person entering their expense claim put the tax amount to zero as the taxes get calculated automatically based on the tax category and configuration. This could be the case on expense claims, or on PO’s or in AP Billls too. When I try to set it to zero I get the following error:

Best answer by Jp89

View original