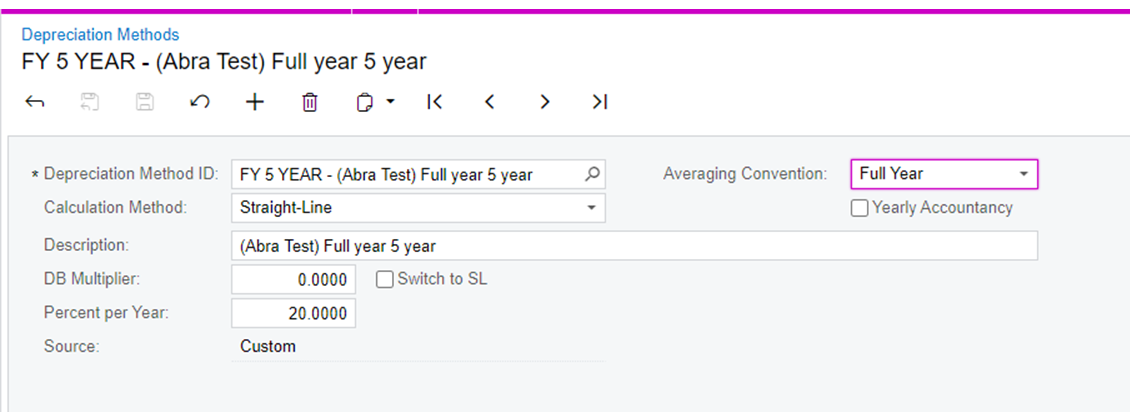

We have a client who needs to depreciate their assets (Land/Property) for a FULL year at a time every year. So they may have some assets that depreciate over 5, 10 or 50 years, but they only want the full amount of depreciation for the year on the last day, NOT monthly.

We thought we could define a depreciation method for the year, but then it wants to depreciate the first full year on the day you enter it and then the next year it will still calculate monthly.

They could do this in their old system, so perhaps I’m just missing something?

How can I define the depreciation method for them accurately and have it only post annually on the last day of the year?