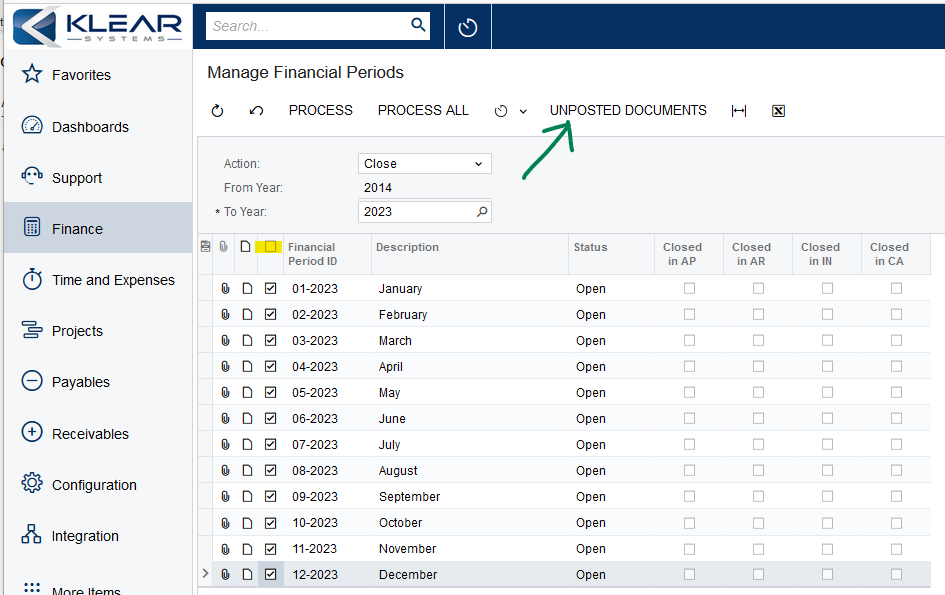

It doesn’t appear that the client ever closed any periods so transactions, in some cases, are getting posted retroactively into prior periods (or years!) For example, the client processed a void check in February that was originally issued in January, so it booked the void in January. I presume this happened because that period was still available for posting. The client is fine actually going in and closing periods in the various modules, including G/L but what they are really seeking is an understanding of what actually happens when they “click the button.” I am researching as well but hoping for some expertise.

Closing of periods in the Acumatica system

Best answer by Laura03

Hello,

Surprisingly little happens when we close a period, IMO.

As you and your client noticed, when periods are left open, the year-end accurately rolls Revenue & Expenses into the beginning balance of Retained earnings in the next year.

Mainly the process of closing periods adds controls. Controlling access to prior periods, controlling posting (or preventing posting) to prior periods is the main advantage of closing out the modules.

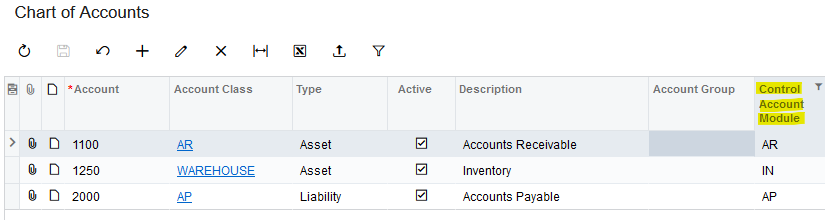

Prior to “pressing the button”, the finance department should be reconciling each subsidiary module with its related accounts in the GL (Ap Aging, AR Aging, Inventory Valuation, PO Accruals, Bank Reconciliation, etc). (I expect your client is already performing these typical month-end tasks.)

Laura

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.