Hello Everyone,

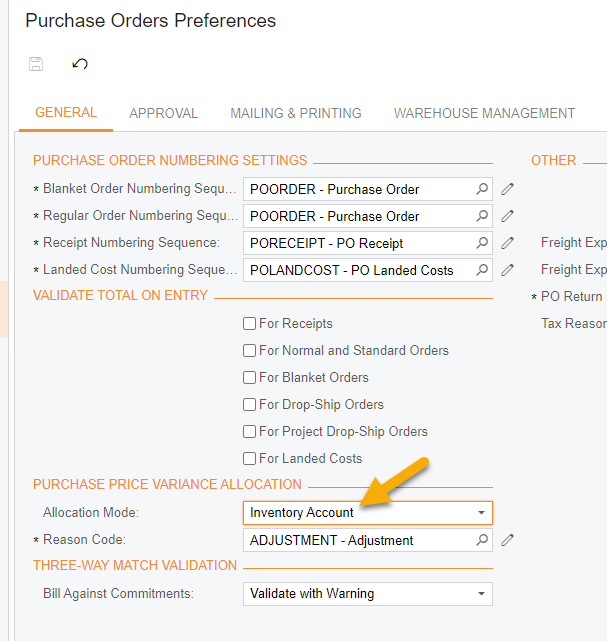

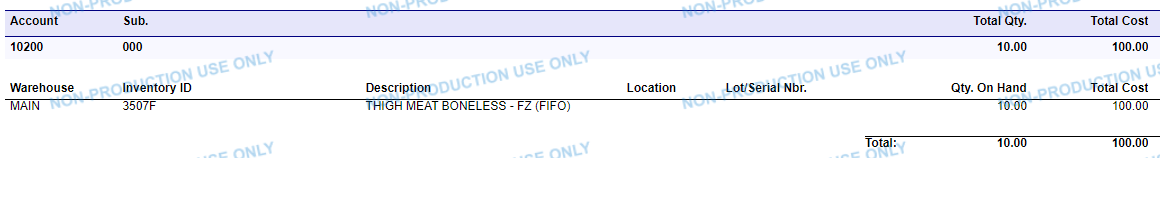

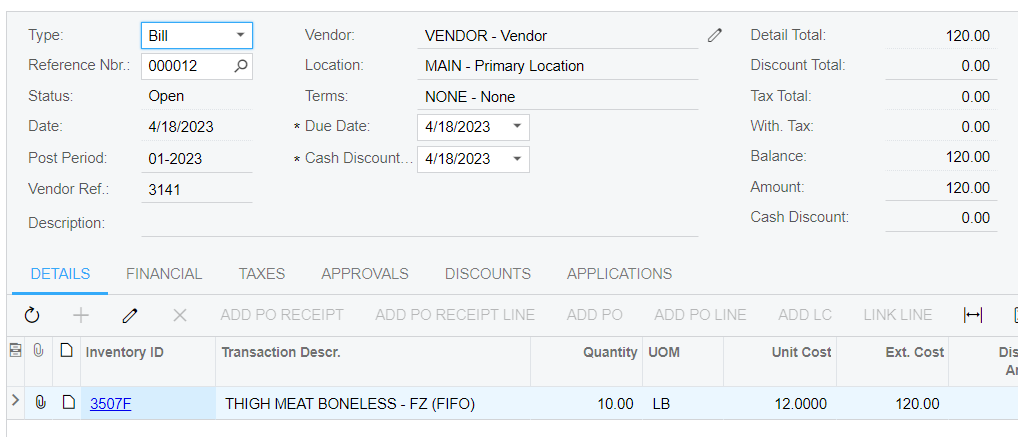

I am playing around with various costing method scenarios in right now. Let’s say I enter a PO for 10 of an item at $100. This item is costed at FIFO. Let’s say the accompanying AP Bill is for $120. I understand there will be $20 going to PPV and $20 going to Purchase Accruals. The cost of the item stays at $10/unit even though the bill was for $120. Is there anyway to retroactively update that item’s cost to $12/unit for this PO/Receipt?

If anyone has suggestions or ideas that would be great. Maybe there is an industry standard.

Thanks