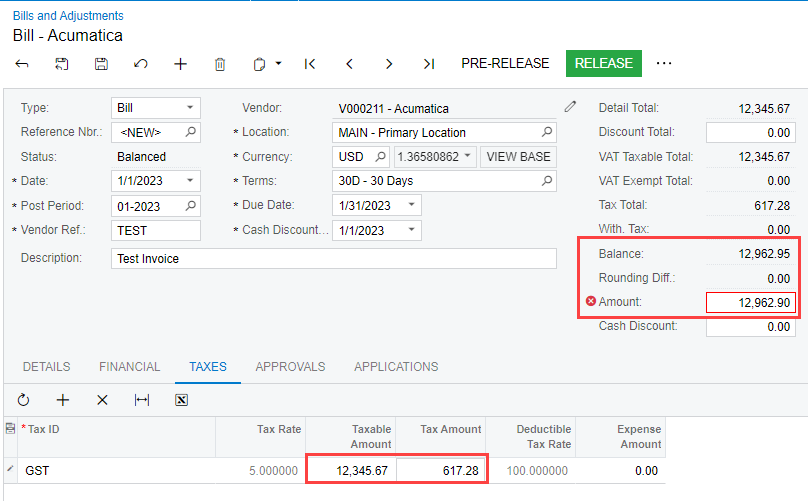

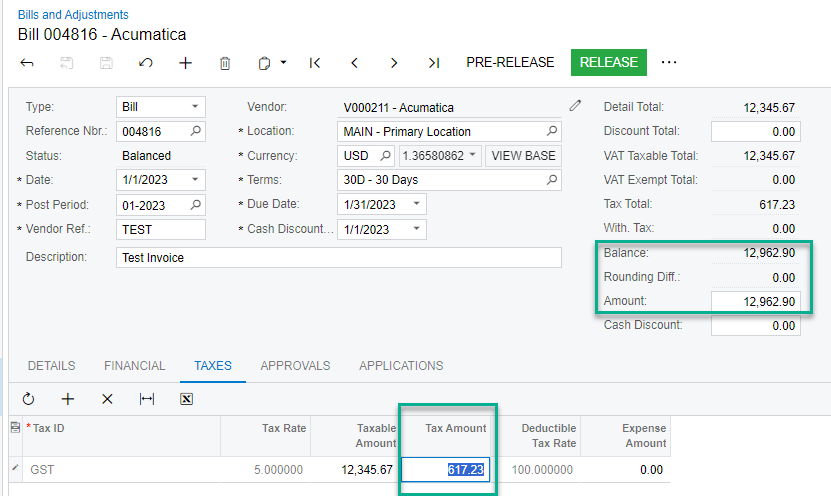

We are a Canadian company that just went live and are finding rounding errors between the GST calculated in Acumatica vs the vendor invoice. The tax is setup as a VAT tax and is set to calculate at the line item level.

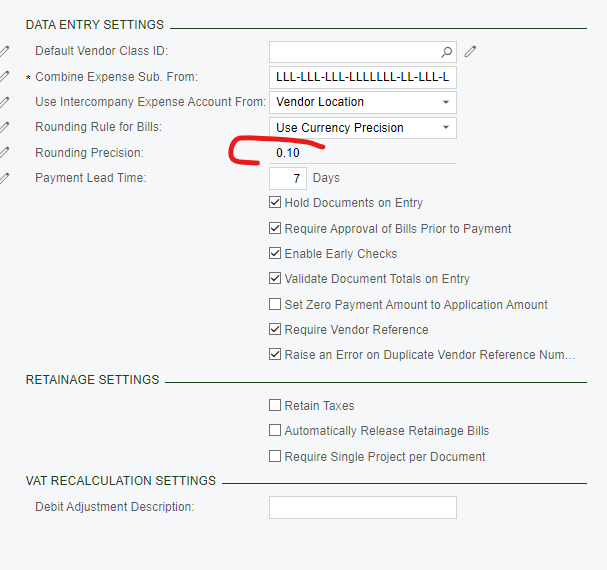

Is there any way to increase the rounding precision of the VAT calculation in Acumatica to eliminate these differences or does someone have a strategy in dealing with these differences.

Best answer by meganfriesen37

View original