Driving myself bonkers. We are using 24R1 and trying to get sales taxes set up. Here is the setup:

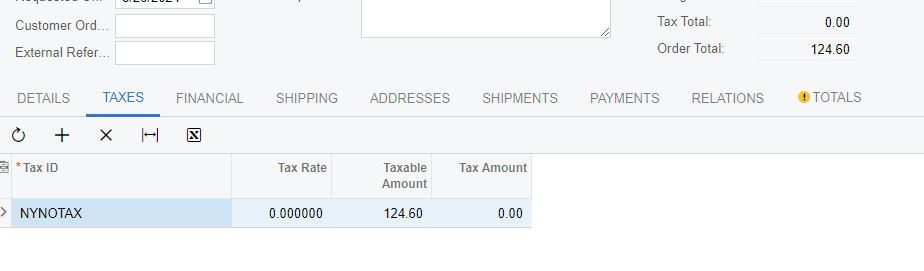

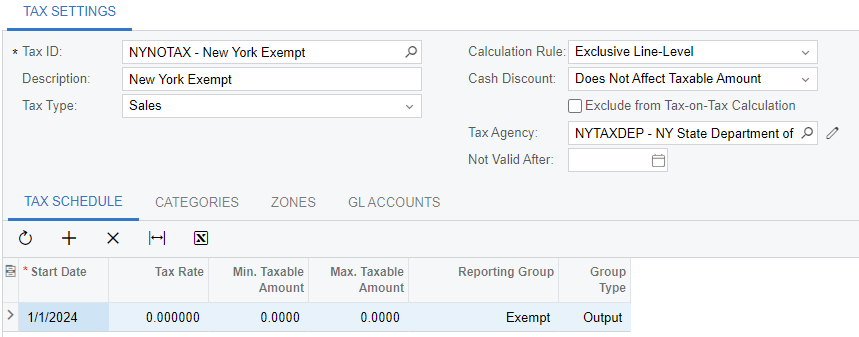

Tax ID: NYSTATETAX = 8.875%, NYNOTAX = 0%

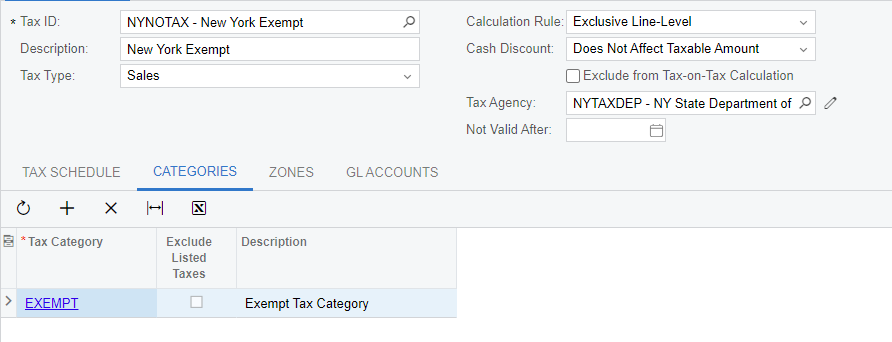

Categories: Taxable, Exempt

Tax Zone: NYTAXABLE linked to NYSTATETAX and Taxable

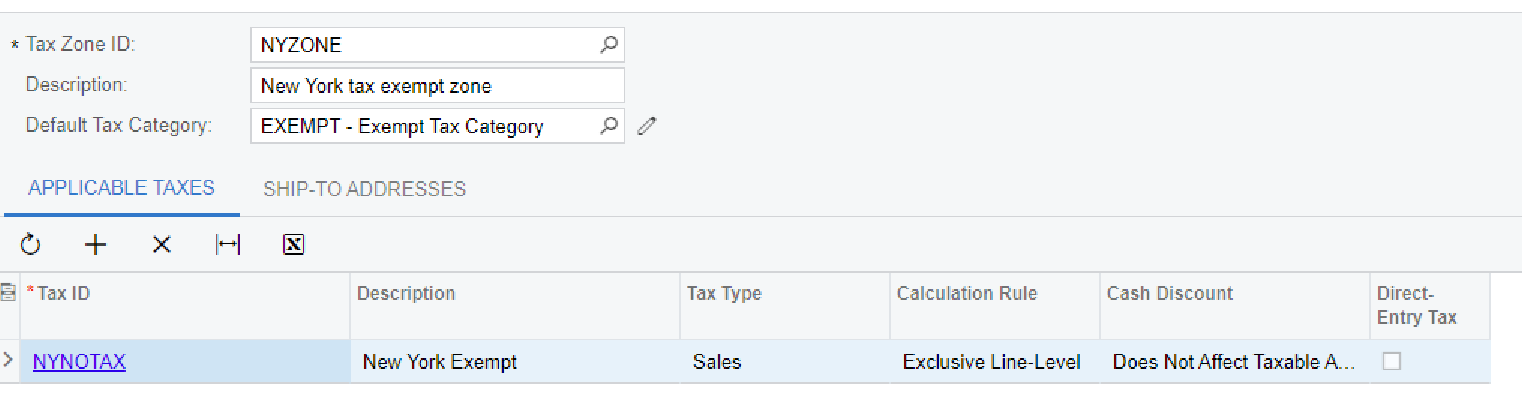

Tax Zone: NYNONTAX linked to NYNOTAX and Taxable and Exempt

All inventory items are set to taxable.

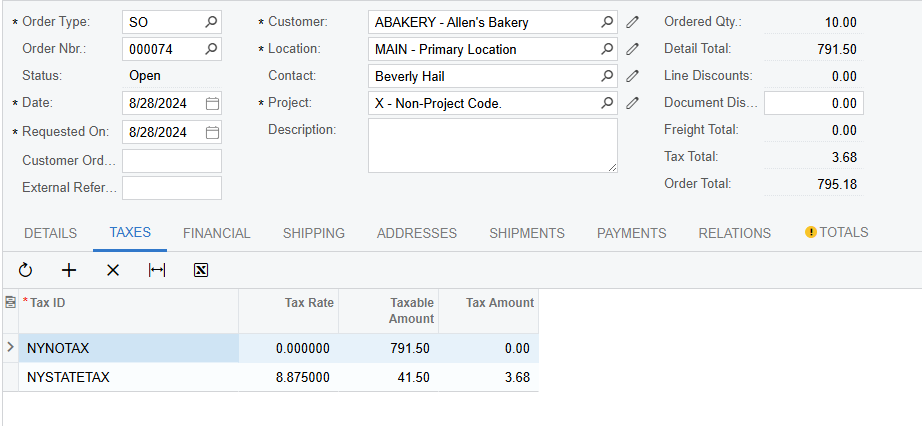

When I create a sales document for a customer with the NYTAXABLE tax zone and a Taxable item ($99.60) and an Exempt item ($25), the correct taxes are calculated, but the tax breakdown is incorrect - the NYNOTAX tax id is missing.

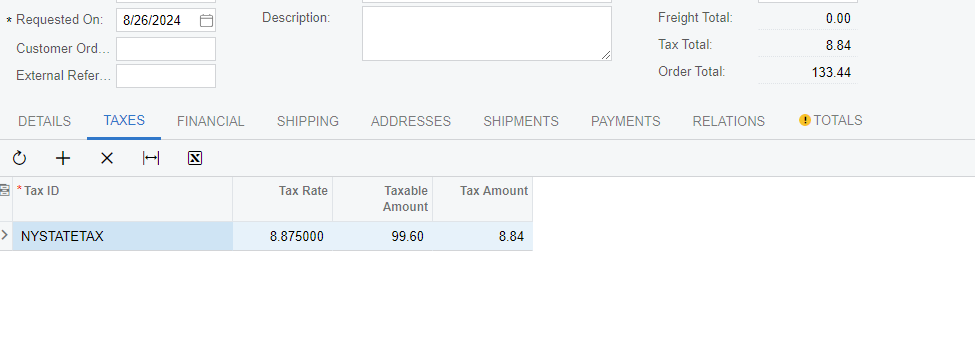

When I create a sales document for a customer with the NYEXEMPT tax zone and a Taxable item and an Exempt item, no taxes are calculated and the tax breakdown on the taxes page is correct.