Hi All,

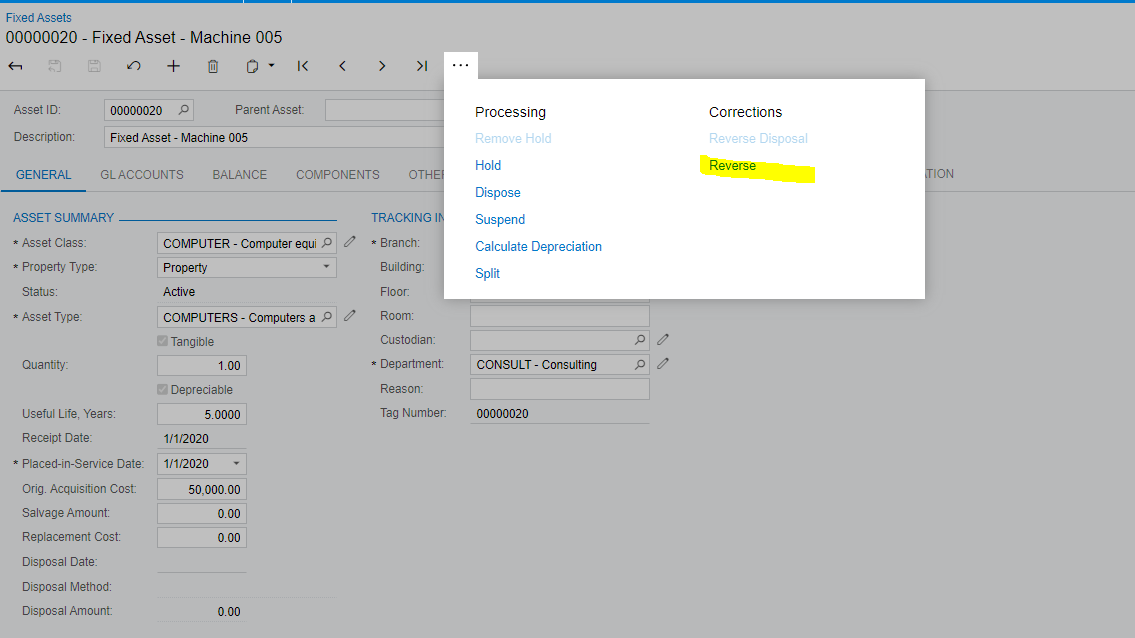

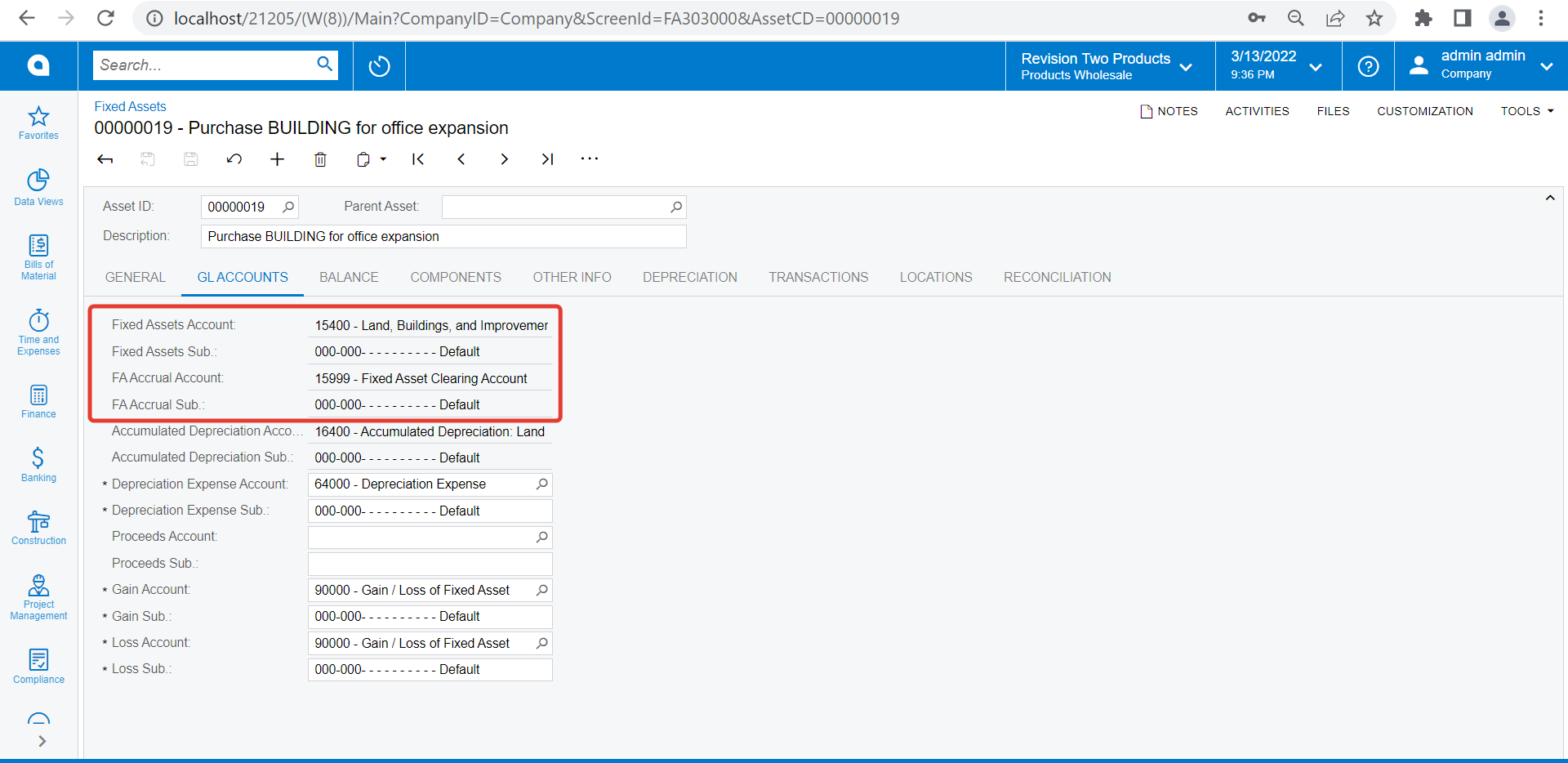

I have select wrong fixed asset in convert purchase to asset. How can I reverse it?

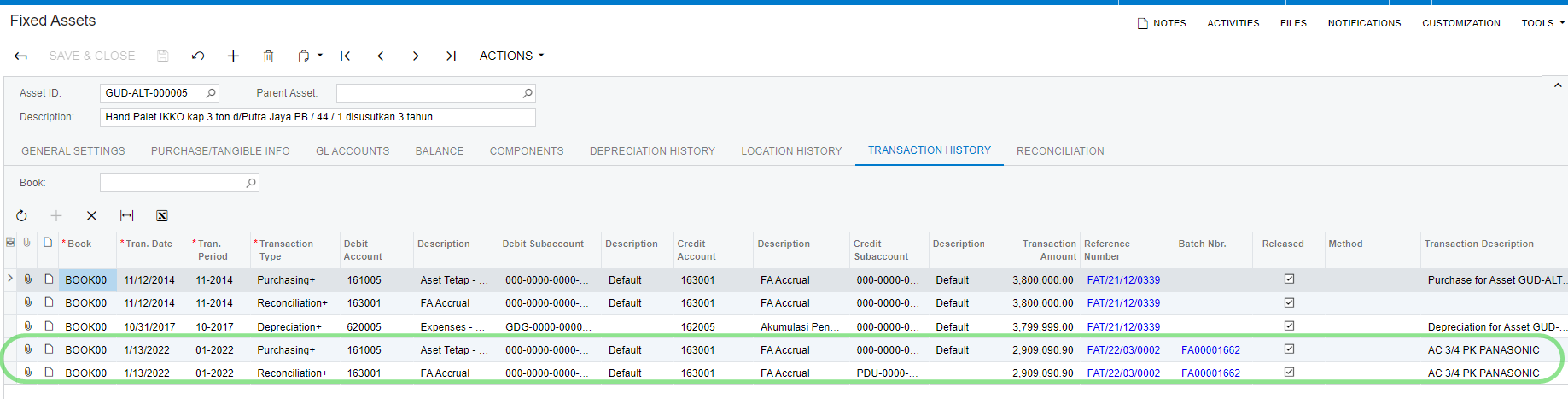

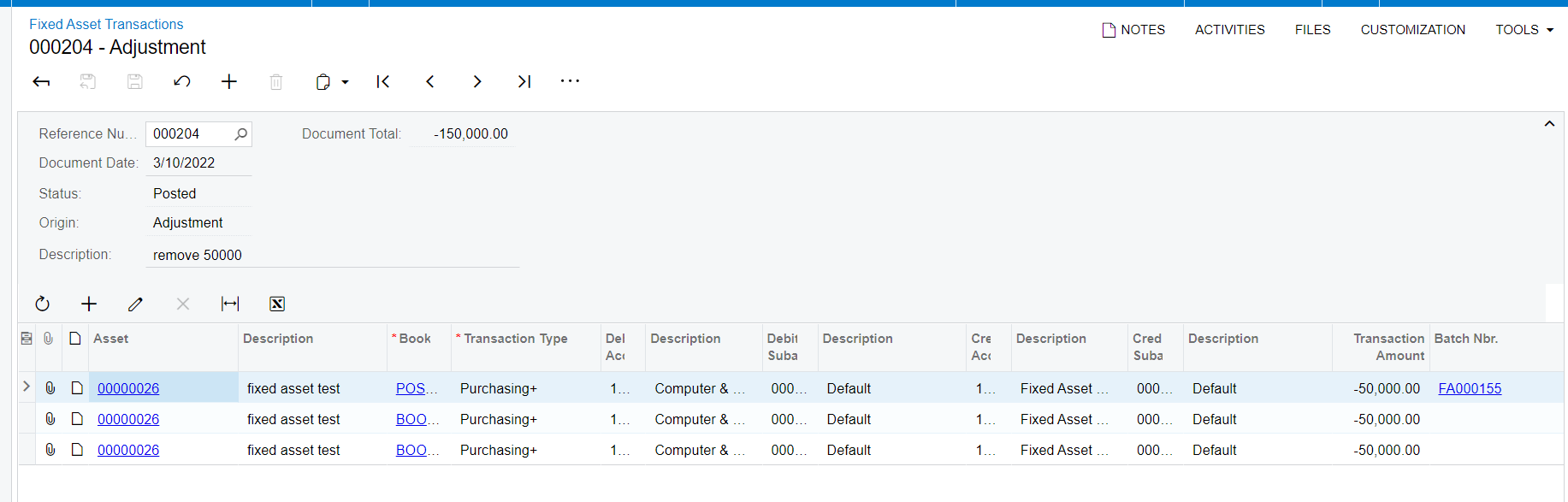

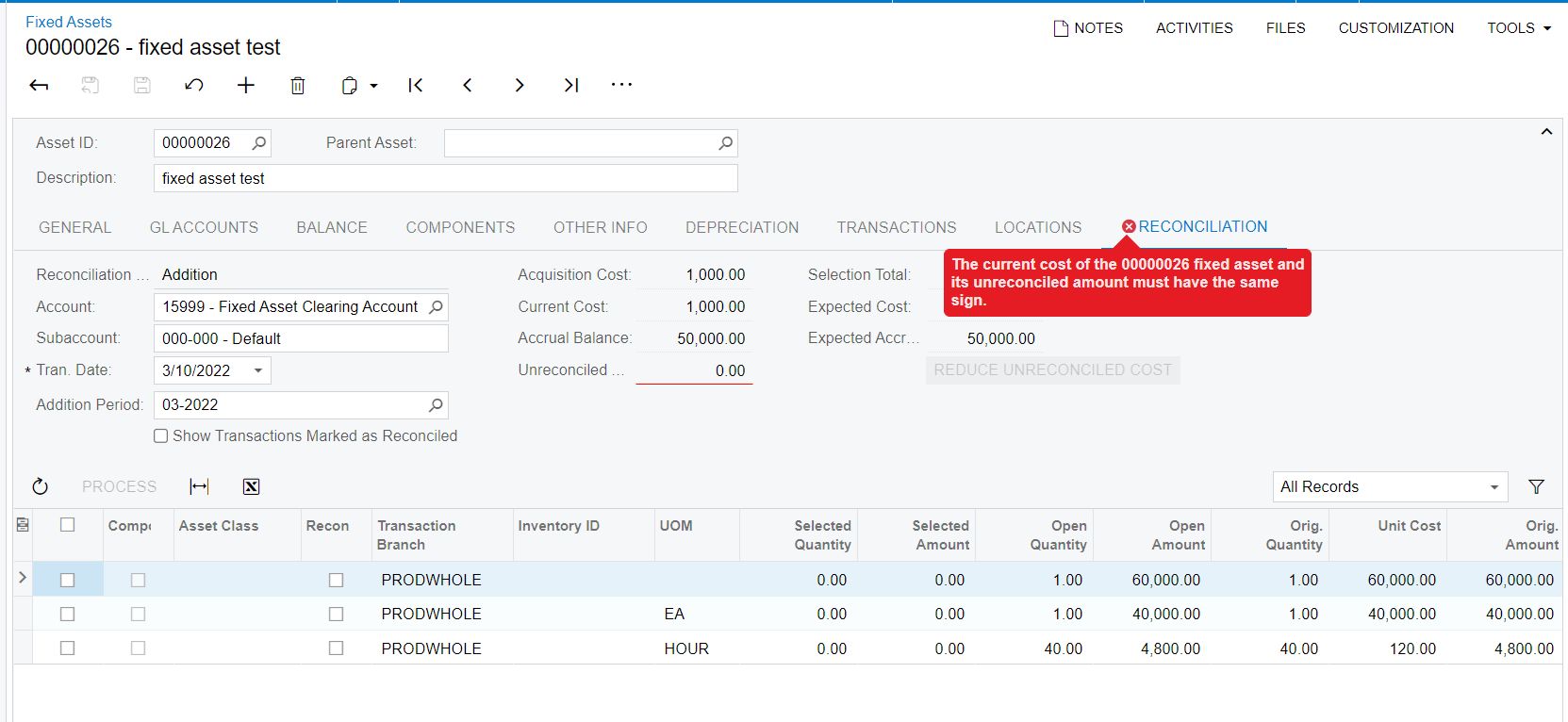

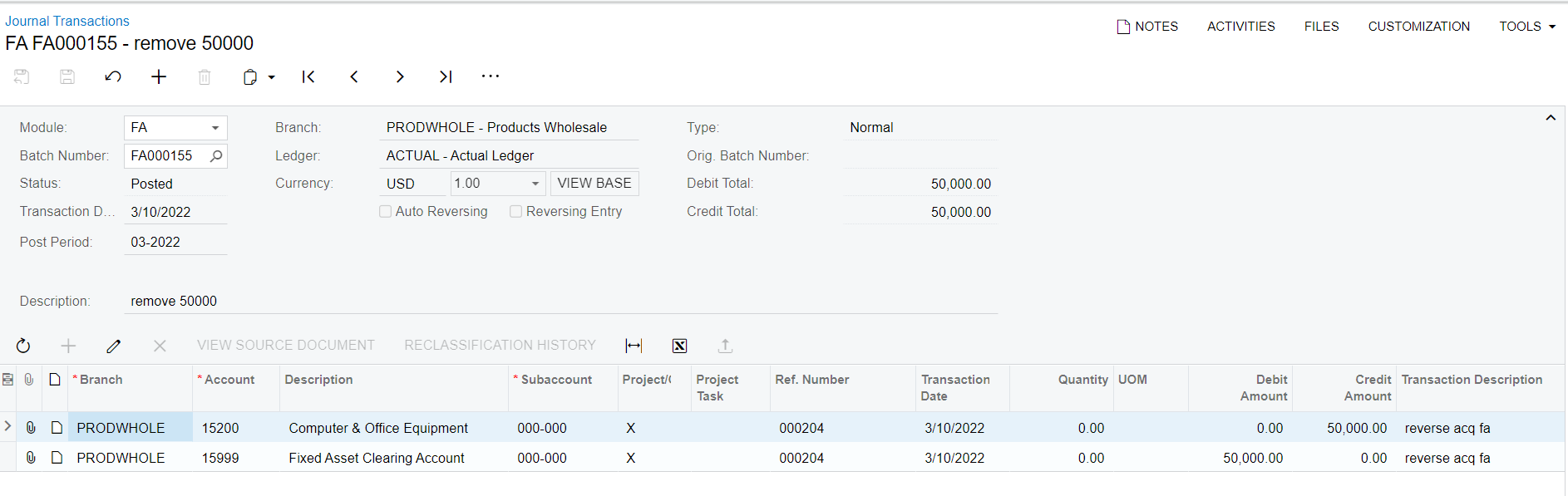

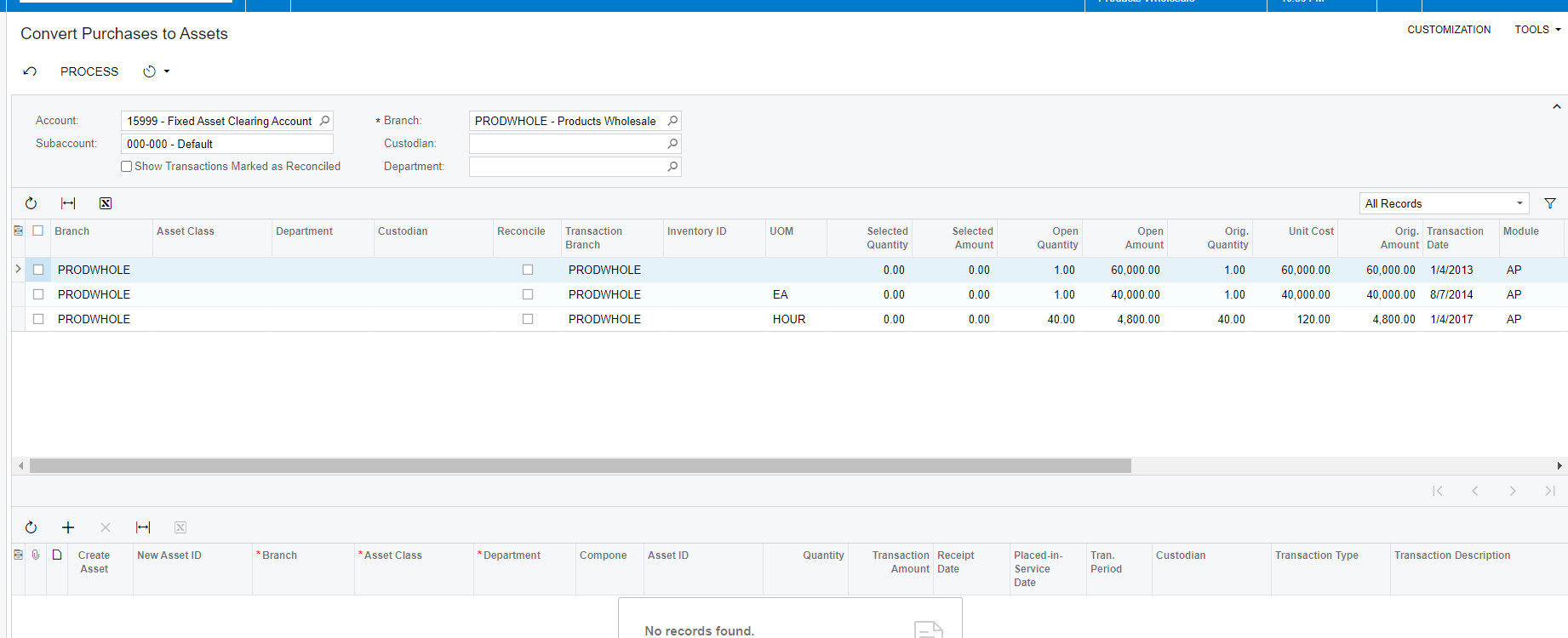

I try to create FA Transaction with transaction type purchase + with negative amount, and it FA Accrual is on debit and asset is on credit (batch nbr FA000155), the asset balance is deducted but it showing error on fixed asset reconciliation tab “The current cost of the 00000026 fixed asset and its unreconciled amount must have the same sign.” and in the convert purchase to asset is not showing the journal of batch nbr FA000155).

Regards,

Sergius Ketaren