Hi Team,

We have a scenario regarding the consolidations of the financial statements. Appreciate if you could give your opinion regarding the scenario.

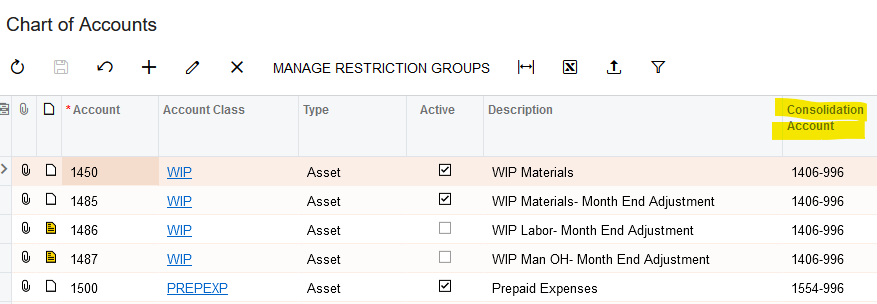

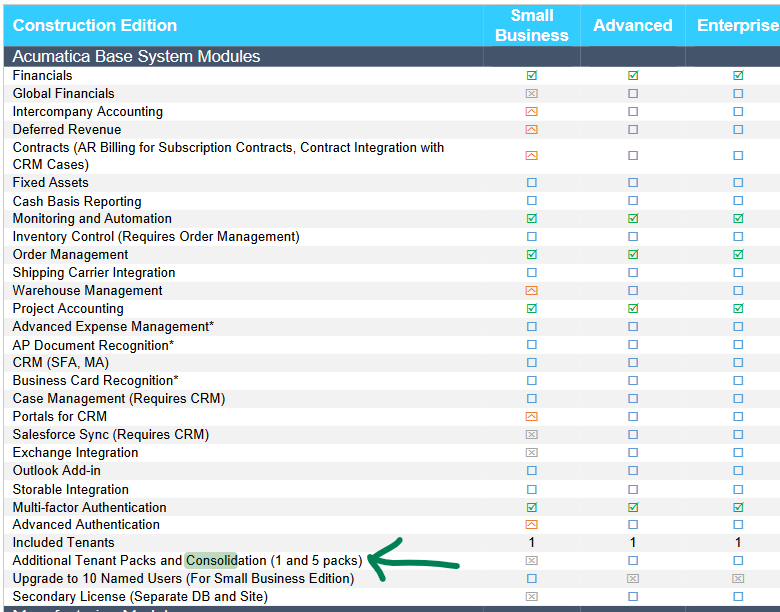

There is a group of companies that contain 10 separate legal entities within the group. And the requirement from the client is to have separate financial statements for those legal entities and at the end of the month or any specific period of time, all the financial statements need to be consolidated. Also, the client needs to maintain 10 separate charts of account structures within the system. I already know we can have only one chart of account structure for all the companies within the system but i need to know whether if there is any workaround for that.

An example for the consolidation scenario is as follows.

Company A has an account for record debtors as "Trade Receivable A" and then company B has an account for record debtors as "Trade Receivable B". At the end of the period, we need to consolidate these two A and B accounts into one account in the balance sheet.

Appreciate if anyone can share a user guide document for the consolidation of financial statements.