We are having an issue with our 3-way match.

- Issue PO - ok

- Goods received - ok

- Invoice received, but cost/quantity does not match PO for some reason

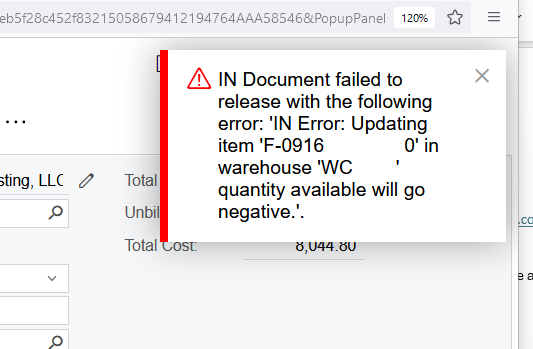

I’ve read that we’re supposed to do a return transaction and then re-receive, but we often can’t do the return transaction, because doing so will throw us negative (and the system kicks an error that won’t let us proceed….we actually have negative inventory enabled).

What is the best way to proceed in this case?