The question is regarding taxation of digital goods sales.

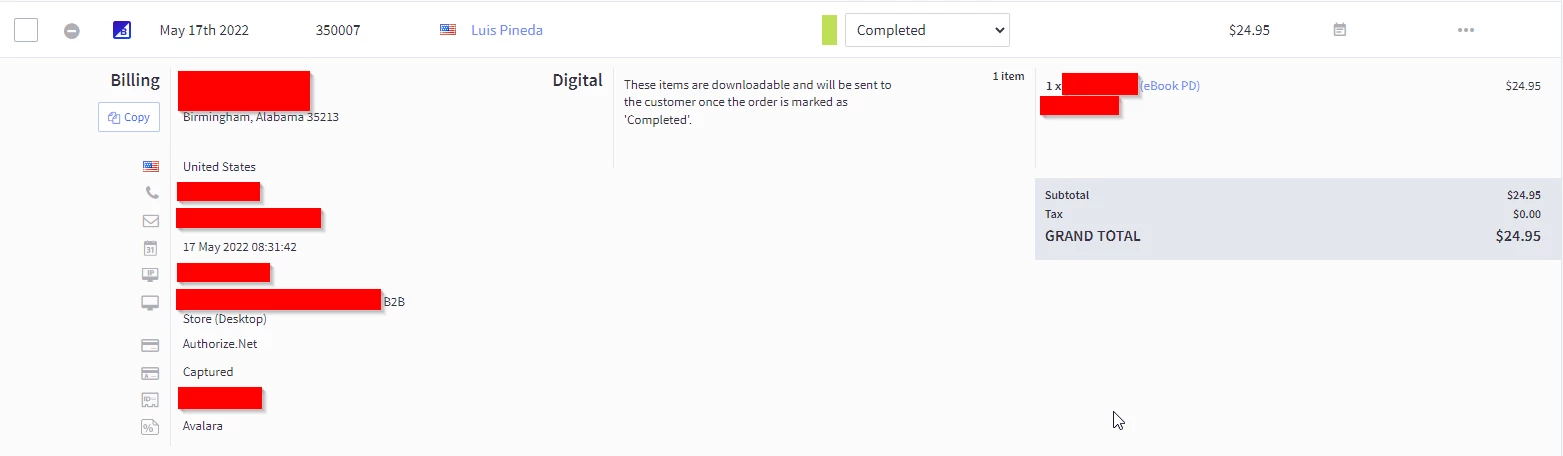

In BigCommerce, you’re not required to provide your shipping address if you’re only purchasing a digital good (eBook, for instance). Therefore, your order looks like this:

You may notice that Avalara still calculates the tax, based on the billing address (which is correct).

However, when this order comes into Acumatica, there is no shipping address, the Ship Via is set to Will Call, and the tax is calculated based on the Warehouse location (which is WA, in this case).

What is the best approach to manage these cases?

Thank you!

Best answer by KarthikGajendran

View original