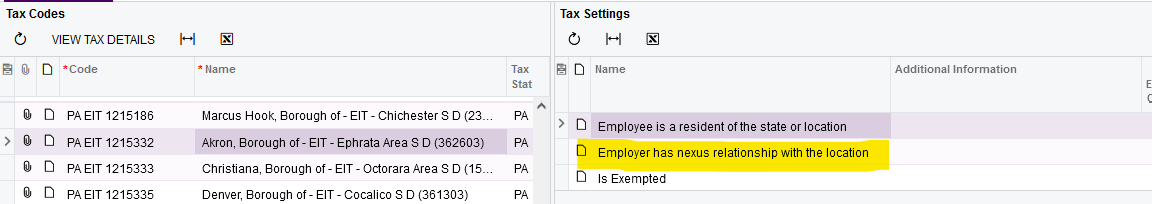

In the Pennsylvania local tax settings, what is the explanation for the use of the “Employer has nexus relationship with the location” setting? There is no additional information in the tax settings column to define this.

Best answer by mpeck12

View original