Hi all,

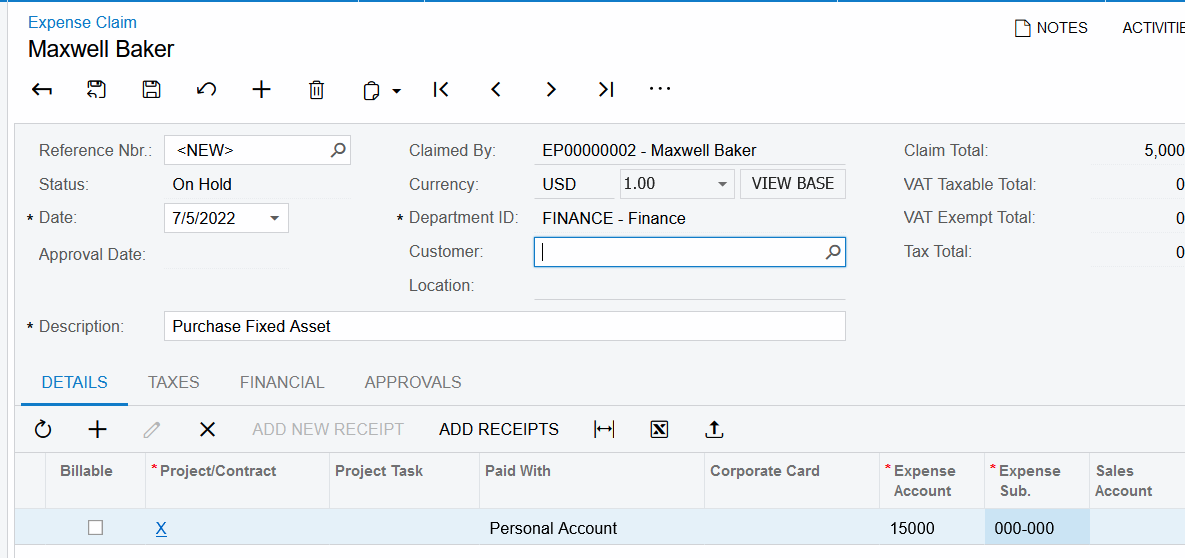

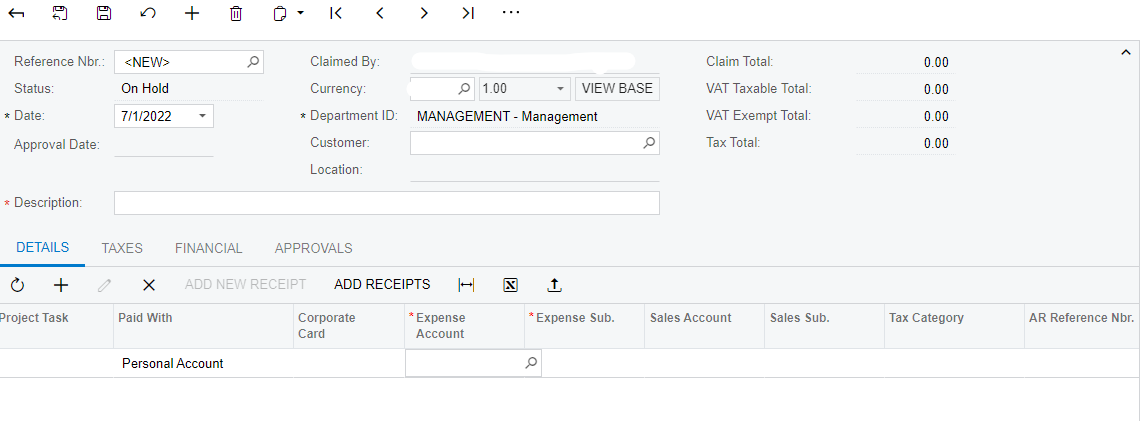

One of our employees purchased a fixed asset using his personal account. Then he needs to claim expense and record this asset into our book. Here in the expense claim form we only see “expense account”, but we’d like to record this amount into “fixed asset” instead of an expense account. So how do we do that? Is it ok if we just key in an account for fixed asset here? Thanks!

Best answer by Laura02

View original